Bitcoin and other cryptocurrencies were once considered as fantasy rather than a viable method of exchanging goods and services, but today many companies — even countries like Saudi Arabia — have adopted forms of cryptocurrency. Even average citizens have embraced the use of Bitcoin in everyday transactions.

In Lebanon, where COVID-19 has exacerbated the economic crisis and caused drastic inflation, there has been a demand for cryptocurrency as a stable alternative to the Lebanese pound and a possible means to avoid government defaults. The Lebanese government has no regulatory laws regarding cryptocurrency, but has issued warnings against its use — the Lebanese Central Bank advocates for its use to be illegal. However, independent crypto-traders estimate the Lebanese population trades between one to five million USD a month using cryptocurrency.

As the utility of cryptocurrencies rise in countries like Lebanon, Hizballah and other terrorist organizations may adopt its use. Additionally, cryptocurrencies are coming under scrutiny lately for their perceived anonymity and how terrorist organizations could exploit the features of digital currency to bypass sanctions and current counter-terrorism finance initiatives. But what are the threats of cryptocurrency to counter-terrorism efforts, is there evidence of their use, and do they provide real utility over traditional finance methods to terrorist organizations?

Cryptocurrency offers terrorist organizations a possible route for anonymous, secure, and reliable streams of funding. They offer anonymity that hackers have used for years as a part of ransomware cyberattacks, as sending, receiving and converting money to Bitcoin does not require the use of a legal name or address. This feature, in combination with a virtual private network (VPN) to hide the user’s true Internet Protocol (IP) address, gives hackers and others anonymity in accessing funds that are not routed through banks.

Cryptocurrency, especially bitcoin, provides security of transfer through encryption and blockchain technologies that drastically limit the potential for hackers to steal funds or the recipients information. While reliability would depend on the donors to terrorist organizations, the characteristics of cryptocurrency provide some incentives to those donors.

The benefits are also incentivizing states to invest in cryptocurrency. Iran, facing economic pressure from US sanctions, has seen a surge in bitcoin popularity — much like Lebanon. While bitcoin is technically illegal in Iran the state is reassessing the ruling and is likely to change. Additionally, Iran is currently planning for the creation of a national Iranian cryptocurrency to bypass US sanctions and embargos.

Yet with all the positive aspects of cryptocurrencies, the evidence suggests that terrorist organizations are not using them on a large scale. Hamas uses some bitcoin but it uses far less cryptocurrency than the average for the civilian population of Gaza. And while Randa Slim (the Lebanese-American director of diplomacy programs for the Middle East institute) thinks that Hizballah has the most to gain from adopting bitcoin usage, there is no evidence to suggest they have begun using it.

The RAND Corporation has examined why non-state actors have not emphatically embraced cryptocurrencies, but subsequently issued a warning for future developments. RAND agrees that while there is an increasing need to understand the full potential of cryptocurrency exploitation by terrorist organizations, that concerns over the abilities of cryptocurrencies to enable terrorist organizations, have yet to materialize. This is because cryptocurrency does not yet provide additional benefit to the areas where terrorist organizations place the most importance in procuring funds than their traditional methods.

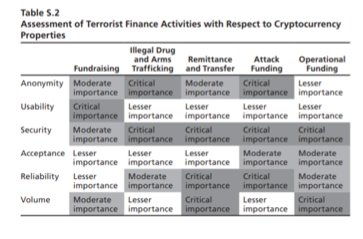

The table below (sourced from the RAND report) shows the levels of importance for the most common aspects of terrorist finance, of which security is of the most importance. While cryptocurrencies like Bitcoin are relatively secure, RAND posits that current cryptocurrency options do not currently provide the security that these highly scrutinized organizations need. However, future improvements to bitcoin could make it appealing to terror organizations for the select use of fundraising.

Source: Rand Corporation

As the economy evolves, and includes continually improving cryptocurrencies, so does the potential for terrorists to adopt the technology. Technological advancement cannot be prevented, but policy that creates regulation and oversight of cryptocurrencies with international cooperation of the intelligence community and law enforcement agencies are crucial steps towards preventing cryptocurrencies from enabling terrorist organizations.

– Cameron Hoffman

- Clarification: According to Bitcoin vocabulary, it is acceptable to use an uppercase B when discussing the concept or network and a lowercase b to describe a unit of account. This is relevant to the textual differences in the above analysis.